When it comes to forex trading, especially when dealing with prop firms, having the ability to manage risk effectively is crucial. Out of the different ways traders try to manage risk, a partial close strategy is probably best known. Partial close is where traders do not close a complete position at a certain level, but rather, close only a portion to secure profit and leave some of the position open for further movement. This approach provides more latitude for flexible risk management, enabling traders to capture profit while still retaining a position, optimizing risk exposure. Automation is arguably the easiest way to execute this strategy, and the MT5 trading platform has everything one would need for such tasks.

In this article, we will examine how to mechanize a partial close strategy with the MT5 tools on offer, how the mechanization of such strategy can change your trading style for the better, and what makes it most advantageous when trading for a prop firm.

Comprehending Partial Close Strategy

Understanding what a partial close strategy is and its significance, before getting into the automation part, is very critical. A partial close happens when a trader decides to close only a fraction of the full position while the remaining part continues to stay active. As an illustration, suppose a trader enters a position with a 1:1 risk to reward ratio. He might decide to close half of the position after the trade moves in his favor a number of pips while still holding on the other half to capture greater potential upside.

It is important to note that this strategy is especially useful in periods of high volatility or when a trader is looking to lock in profits while allowing the remaining portion to continue developing further. Partial close enables traders to gradually scale out their positions, thus minimizing exposure and risk without losing the entire value of the trade. When dealing with a proprietary trading firm, this flexibility in position management can make all the difference, as the firms usually have stringent regulations on drawdown levels, loss limits, and overall risk tolerance.

Gains from Implementing Automation in Partial Close Strategy

The merits of automating a partial close strategy are numerous. For one, automation guarantees operational execution free of emotional bias. In live trading, a trader’s judgement can be impaired due to feelings of fear or greed. With automation, a trader ensures that the strategy is executed as per the automated rules devoid of unanticipated exits or missed opportunities.

In addition, automation removes the constant monitoring burden from the trader’s shoulders. Even with a partial close strategy, the trader usually has to make some decisions based on price action. With automation, the system can manage the position at set parameters, including executing partial closures at predetermined levels or based on other established criteria. Moreover, this is beneficial to traders who spend limited time in front of their screens and those operating in prop trading environments where they work under strict time limits.

Finally, automation enables execution of more sophisticated strategies which would be extremely challenging to handle on a manual basis. A good example would be a strategy that employs a trailing stop coupled with a partial close, allowing the trader to secure profits while also providing the opportunity for further gains. Automation of these elements adds a more systematic and less hands-on approach with trading.

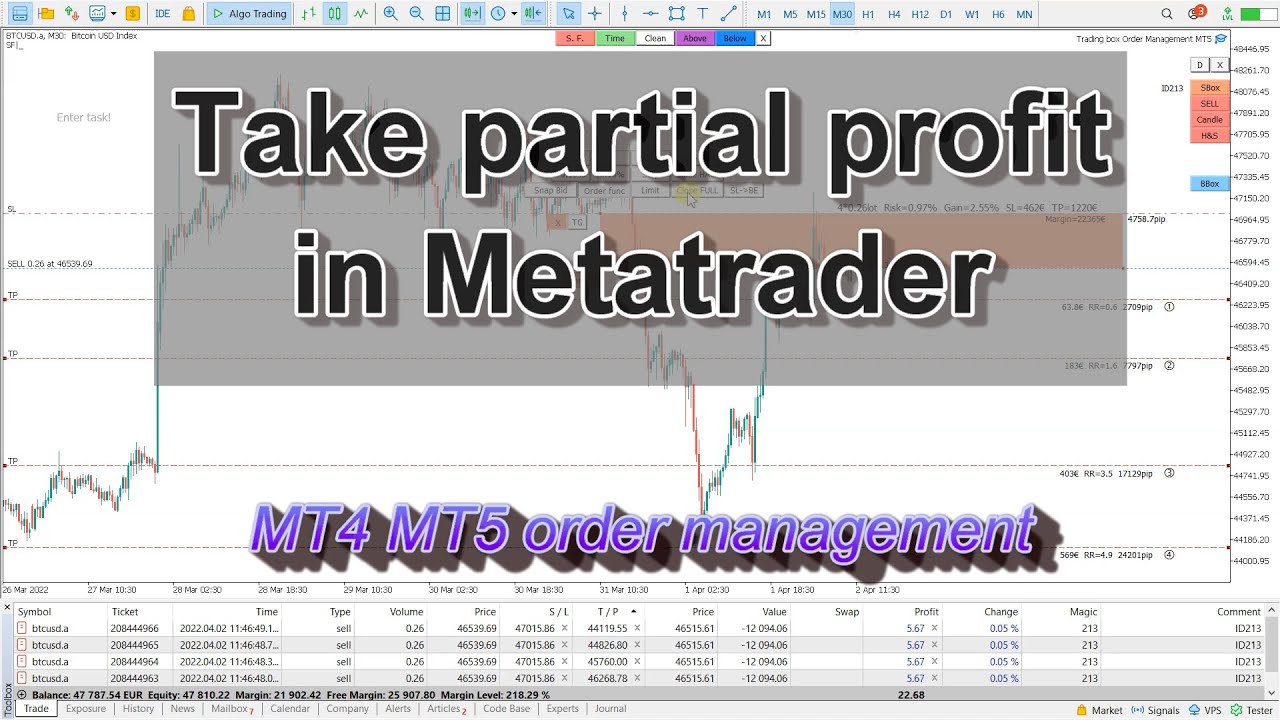

Partial Close Automation Tools in MT5

Several of the MT5 tools can assist with the automation of a partial close strategy. Among the scripts, experts, as well as integrated order handling capabilities. Let’s demonstrate which of the tools can be utilized to create a partial close system.

Expert Advisors (EAs)

The most potent weapon for the automation of any trading strategy in MT5 is the so-called Expert Advisor. These are algorithms that enable the trader to execute virtually all components of his trade, including partial closes, which he has programmed them for.

You would need to program or download an EA that allows for partial position closures in order to set up an EA for a partial close strategy. Many EAs come with customizable settings such as the closing portion of the position, the price level that triggers the partial close, and the specific portions of the trades that will be closed after profit targets. The installed EA runs on autopilot, actively monitoring your trades and executing partial closes according to your predetermined settings.

As an example, you can instruct the EA to automatically close 50% of the position once 20 pips of favorable movement is achieved. There is no human action needed; it is done automatically. Also, you can modify and cancel limits on losses for closing positions to improve the security of the remaining position.

Scripts and Custom Orders

Apart from Expert Advisors (EAs), traders have the option to automate partial closes with custom scripts. Compared to EAs, scripts are simpler in design. They perform more specific functions such as executing partial trade closures. Scripts can either be authored in MQL5, the programming language of MT5, or purchased from the MT5 marketplace.

Scripts are very useful for a specific one-off action, for example, closing a predetermined percentage of an open position when a certain price is reached. The participant can activate the script and a certain portion of the trade will be automatically closed, thereby removing the need for manual intervention.

Although scripts have limited functionality when compared to EAs for active management of trades, they offer excellent utility to traders who wish to automate certain tasks without constant oversight.

Built-In Order Management Features

In addition to order management features, the MT5 trading platform comes with additional tools to execute partial closes. The platform supports partial close orders where it is possible to give multiple orders for a single position. These orders can be used to execute partial closes in a manual or automated manner.

As an example, you can place two separate orders for the same trade, one with the full position size and one with a smaller portion. When the first order hits a profit target, you can manually close part of the position with the second order. It is true that this method is not fully automated and requires more attention, but it can still be useful for some traders who want to monitor their trades but do not want a hectic hands-on approach.

Furthermore, the MT5 platform features a trailing stop function, which when integrated with partial closes increases flexibility concerning loss limits. The trailing stop function automatically shifts the stop loss level upwards as the price moves favorably, guaranteeing profits and providing a safety net for the balance of the position.

How to Set Up Your Partial Close Strategy on MT5

To set up a partial close strategy in MT5, you will need a blend of trade management techniques, technical analysis, and proper tools. Primarily, you must figure out when and how much of your position you wish to close. Typical options are closing a portion of the trade when a preset number of pips are gained, a key support or resistance level is attained, or an indicator provides a certain signal.

After deciding these conditions, they can be automated using scripts or an Expert Advisor. Traders operating as employees within a prop firm, for instance, face strict risk management parameters. Therefore, the auto-execute feature for partial closes helps maintain consistency and discipline. Such prop firms operate with set drawdown limits and tightly controlled risk parameters, automating partial closes where limits can be set ensures drawdowns will not exceed limits while profit extraction at predefined targets is guaranteed.Optimization and Testing

MT5 allows you to fully test and optimize your automated partial close system with its extensive set of tools. It has a strategy tester that lets you backtest your automated partial close system using historical data. This means you can see how well the system functions in different scenarios on the market, giving you the opportunity to make a variety of changes, modifications, and optimizations to your strategy.

While working specifically with prop trading firms, testing is of the utmost importance as most prop firms require traders to prove they can adhere to a specific risk management framework. Test after test, refine your strategy and automate your workflows so that your prop teacher’s expectations will be surpassed effortlessly.

Final thoughts

Partial close strategies and other similar automated workflows certainly enhance trading with the MT5 platform with the help of Expert Advisors and custom scripts. Setting this automation allows schemes on when profits will be taken for various positions away from the market while still being up for more proficient advancements. Partial closing and effectively balancing risk and reward becomes effortless without emotional distortions.

For traders dealing with a proprietary trading firm, the automation of a partial close strategy serves more than the purpose of optimizing efficiency; it is a means of aligning with rigorous risk control protocols and enhancing the probability of steadily accruing profits. If this strategy is well devised and tested, it can greatly improve your trading performance.